10% APY on your Bitcoin. Non-custodial.

Institutional yield strategies for serious BTC holders. Yield without surrendering control of your coins.

Yield options ask too much

Think existing Bitcoin yield products ask too much and deliver too little?

So did we.

Custodial products require handing over your Bitcoin. DeFi rates collapse when liquidity does. Until now, earning yield meant accepting trade-offs most serious holders wouldn't.

So what’s the alternative?

The answer is here

Non-custodial Bitcoin yield with Cobault.

You get the return upfront — 10% APY on the staked position. In exchange, your BTC upside is capped at 20% during the term. If Bitcoin rises beyond that, you keep your guaranteed yield, but not the additional upside.

It doesn’t matter if Bitcoin price goes up or down. You yield 10% APY either way.

Full control. Zero risk.

While staking, you and Cobalt share cryptographic control via multisig, governed by smart contract policy. Neither party can move funds unilaterally, eliminating counterparty custody risk.

Audits in progress

Code to-be open-sourced

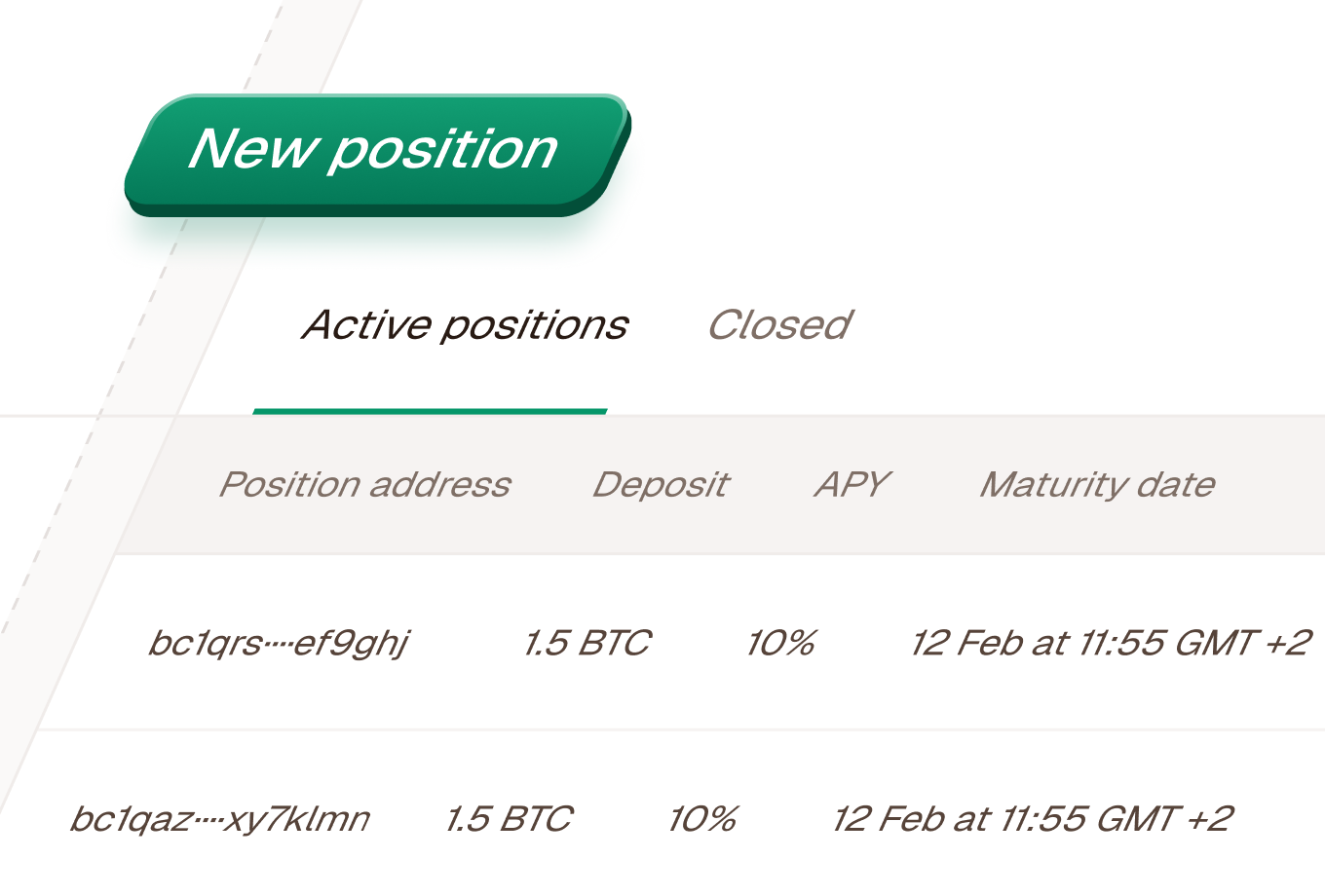

Simple. Quick. Transparent.

Open a position with a BTC price cap. You can deposit whatever you want.

Deposit and wait. Funds are secured with a multisig contract. You’re in control.

Whether Bitcoin price goes up or down — you yield 10% APY either way.

Q2 2026

Early access program

We're building our founding cohort now. Join the waitlist for updates and early access.

Thank you for joining the waitlist.

Ceiling & payout

Your payout depends on the price ceiling and BTC price at maturity date. Here’s an example:

Your deposit

1 BTC

APY

12%

Maturity period

20 days

BTC price ceiling

120,500 USD

Total yield

0.00658 BTC

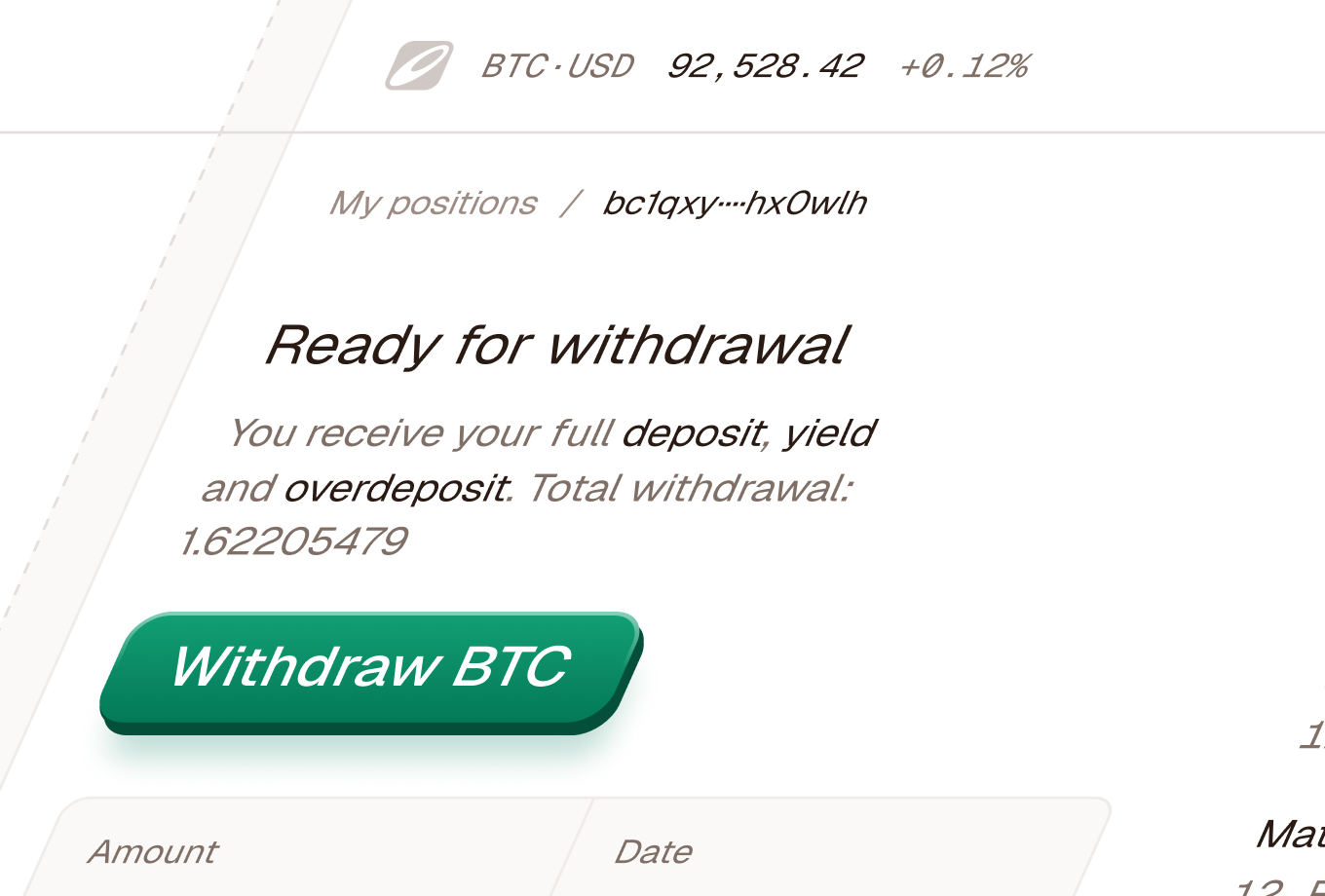

If BTC price stays at or below the ceiling...

120,000 USD

If the price stays at or below the ceiling at maturity (after 20 days), you get your yield and deposit back in full.

Deposit

1 BTC

Yield

0.00658 BTC

Total

1.00658 BTC

Net profit

0.00658 BTC

If BTC price goes above the ceiling...

120,000 USD

If the price goes above the ceiling at maturity (after 20 days), you get the full yield in BTC, but deposit value is capped at the ceiling.

Example: BTC hits $120,500 at maturity. Capped deposit:

$120k ÷ $120.5k × 1 = 0.99585 BTC

Deposit (capped)

~0.99585 BTC

Yield

0.00658 BTC

Total

~1.00243 BTC

Net profit

0.00243 BTC